Before we talk about accumulating RM1.3 million, let’s talk about this.

Over the past few weeks, I’ve seen few articles and social media posts explaining how someone can potentially accumulate RM1.3 million in EPF over a working lifetime from the age of 25 yo today.

These articles are generally well-intentioned. They aim to encourage saving, show that despite the stress around money and escalating cost of living, retirement is possible, and intend to provide hope to people that starting from a modest salary does not mean a future that is bleak.

This post here, it is not meant as a critique of those news, nor is it an attempt to question the validity of Retirement Income Adequacy (RIA), which is a benchmark recommended by EPF. Instead, I am writing this with the intention to support readers interpret these numbers in a proper context, so we don’t unintentionally walk away with the wrong conclusion.

WHAT RIA AND EPF BENCHMARKS ARE REALLY ABOUT

The benchmark for retirement savings such as RM390,000, RM650,000, and RM1.3 million exist for a reason.

They are designed to raise awareness about retirement adequacy, meant to provide a reference point for planning, encourage consistent long-term saving, and help policymakers and institutions communicate a broad message.

In this case, the number here also meant as a guide for people to gauge their spending limit in their retirement years. It is worthwhile to remember, however, they are not personalised retirement plans, and they were never meant to be read as guarantees or a ‘one-size-fits-all’ number.

Essentially, the RIA benchmarks are guides, not promises, and the number we see from there are expressed in today’s purchasing power. It is how much the amount can buy today.

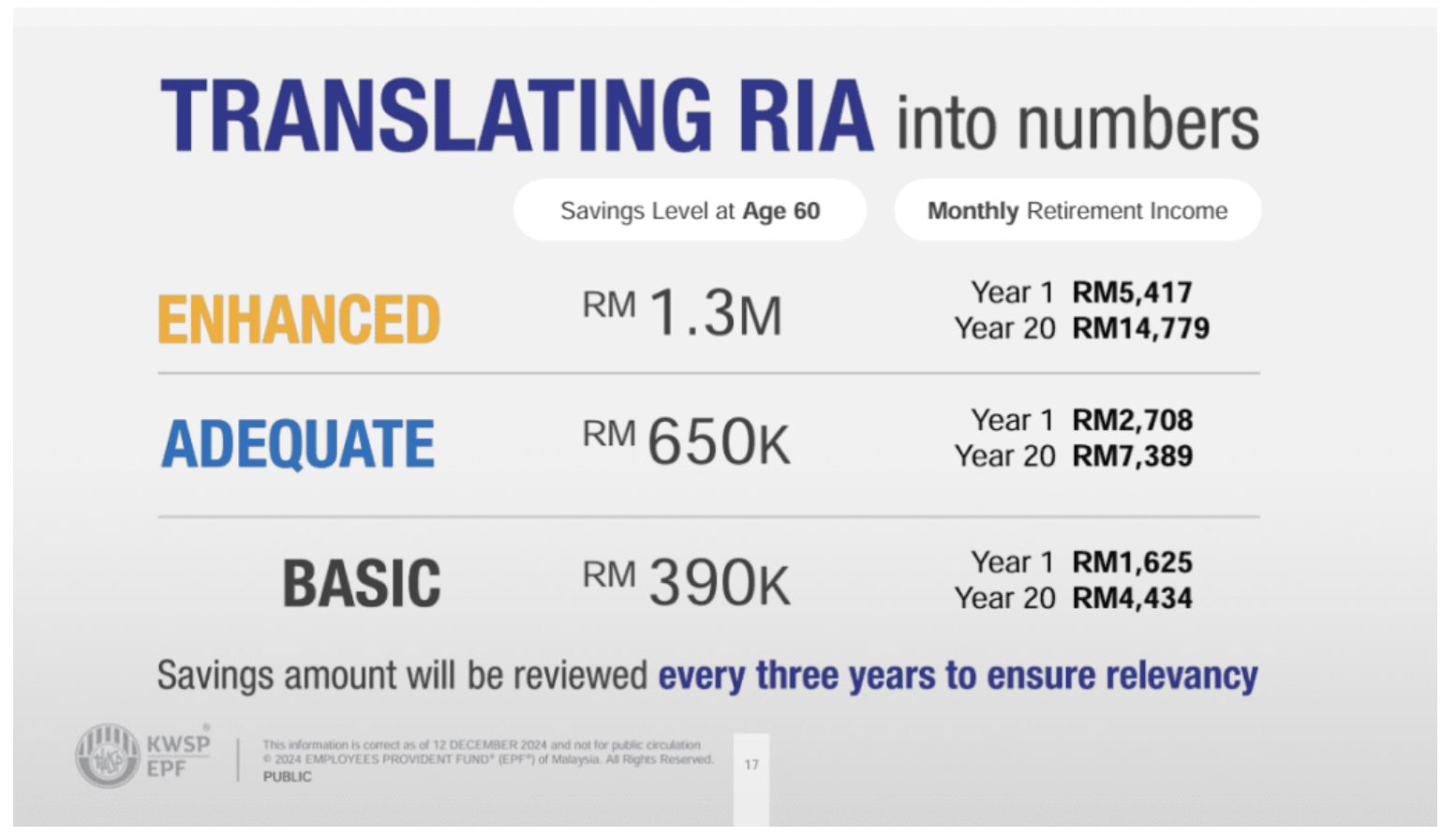

This visual helps translate retirement savings into estimated monthly spending, assuming retirement around the time the benchmark was designed for. It is meant to help us spend with better clarity, but not certainty.

TIME IS ESSENCE

The value of our money do not stay the same over time. In fact, it can grow; or reduce over time.

When it grow (compound), we have more money to spend, whereas when its value shrinks (discount), we will need to spend more to buy the same quantity of items. Generally, today’s money will have a higher purchasing power compare to the same amount 1 year later, due to inflation.

This is one of the most fundamental ideas in financial planning, the time value of money.

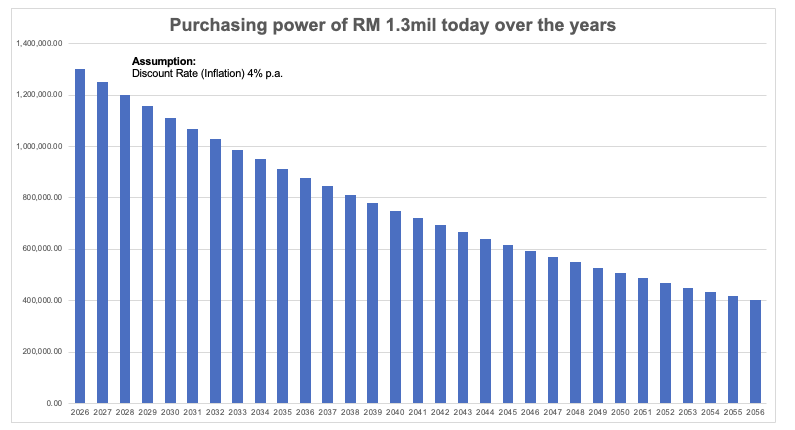

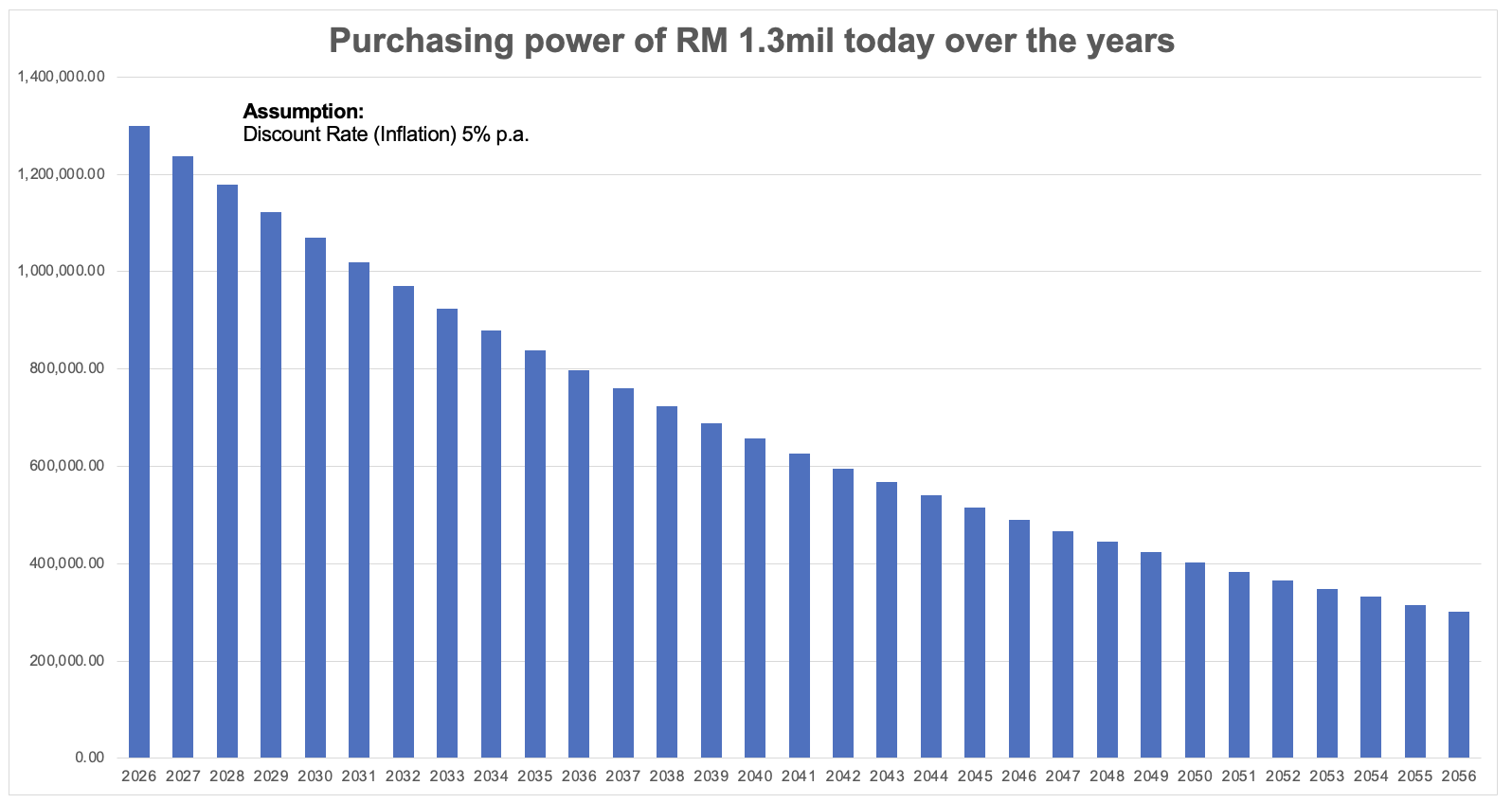

At an average inflation rate of 4% per year, RM1.3 million 30 years from now has roughly the same purchasing power as about RM400,000 today. This means while our bank account may still show a balance of RM 1.3mil in 2056; but it only worth what we can buy with RM 400,000 today.

Be that as it may, this does not mean the reference point of RM1.3 million is wrong. It simply means that the year matters. In fact, the reference point of RM 1.3mil is referring to the amount of savings a retiree should have today (in 2026), so that this person can spend about RM 5,400 a month NOW.

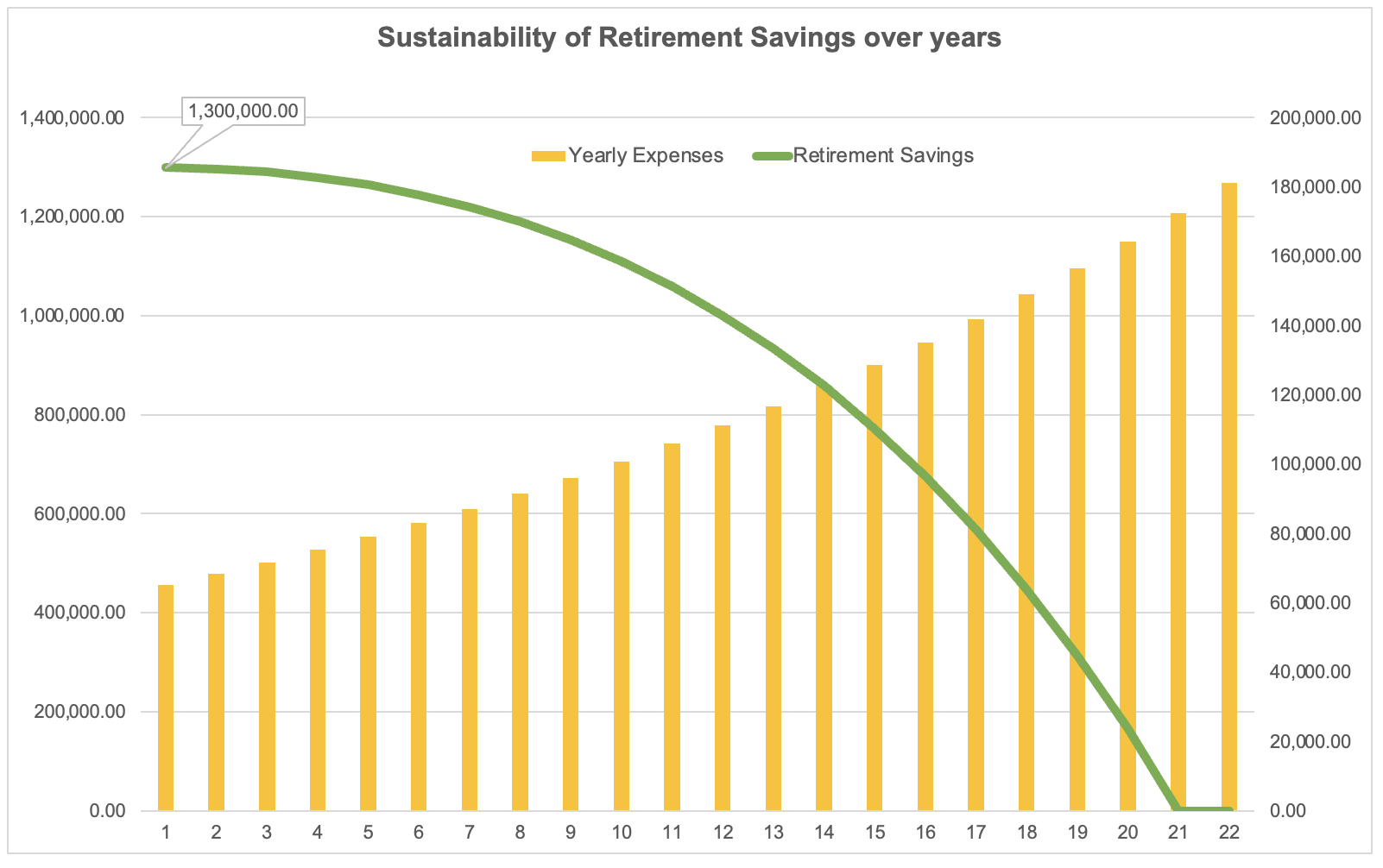

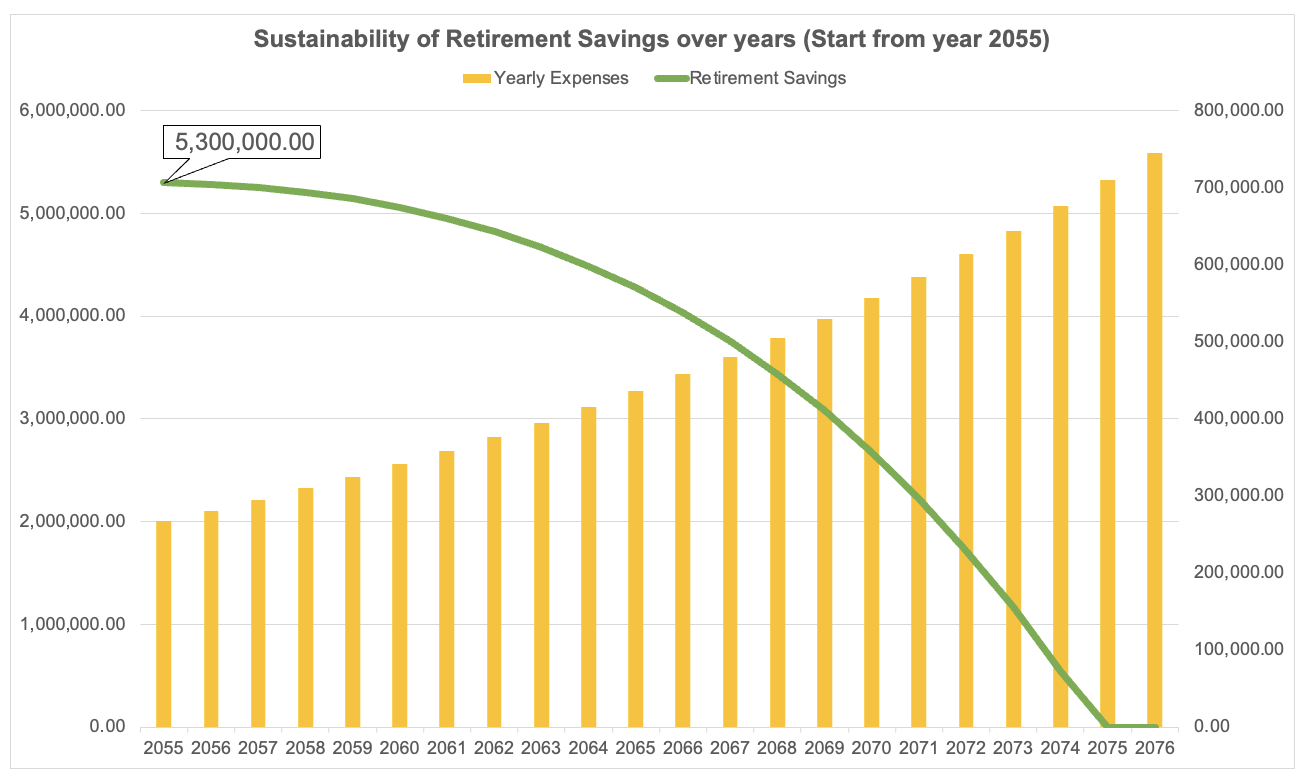

This illustration shows how retirement savings decline over time while expenses rise, assuming retirement begins today and spending increases with inflation.

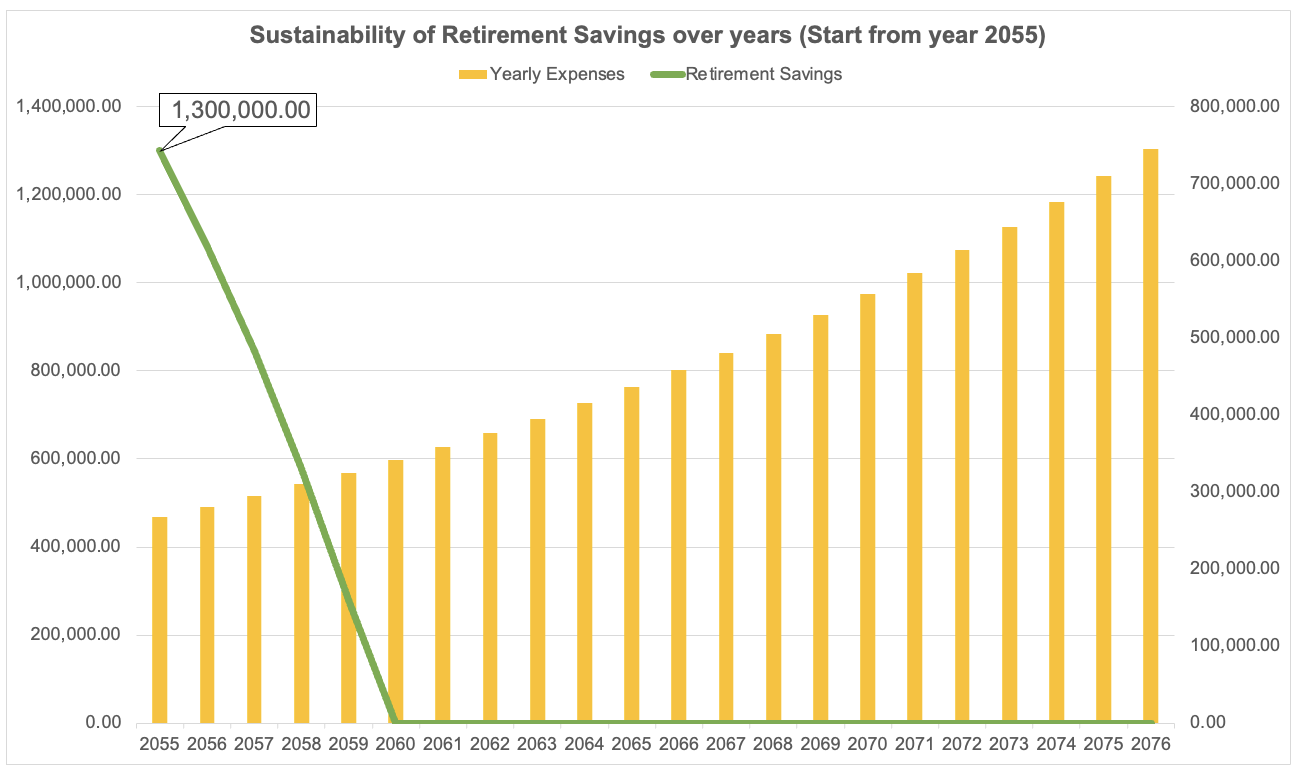

If a person is not 60 yo today, but will only reach age 60 yo 30 years from now, then this person who have amassed RM 1.3mil and try to live the lifestyle equivalent to RM 5,400 a month today, will be in for a shock.

The same savings amount produces very different outcomes when retirement starts 3 decades later. The same RM 1.3mil can only sustain the lifestyle for merely 5 years. Time changes everything.

The scenario above happened simply because the value of RM 1.3mil is only worth RM 300,000 today.

Sometimes, a picture explains this more gently than words. The same number slowly loses purchasing power as time passes.

For the person who retire 30 years from now to have a similar lifestyle, for a similar 20 years retirement period; this person would need about slightly more than RM 5 million at that time.

30 years later, a retirement savings of RM 5.3mil is required to maintain a lifestyle equivalent to about RM 5,400 a month today (keeping all other assumptions same).

What are we assuming?

Many projections assume steady salary growth, consistent investment returns, and uninterrupted employability. These assumptions are not wrong, in fact, none of us know what may happen in the future, but yet, like many people who comments on these stories, these assumptions may at-risks of being too optimistic and may not be relevant to everyone.

Maybe, as important as what these numbers mean, is actually what they are not.

When we only make assumptions and projections around our salary growth rate, dividend rate on retirement savings, how long our retirement years will be, how much we will be spending then, and etc, we might overlooked how dynamic LIFE actually is.

These means we may also missed out thinking about things like…

Individual lifestyles, how it changes across retirement years.

Health conditions, will our spending be same for the next 20-30 years?

Family responsibilities

Debt levels, many of us may have mortgages that ends at 70 yo but not 60 yo.

Location and cost of living, this have a strong influence on our monthly spending.

Longevity differences, the longer we live, the more we need to spare. and we are living longer than just 60 years + 20 more years.

So, it will be helpful for us to not maintain this mindset

“If you hit this number, you’ll definitely be okay.”

Wrap-up

In fact, I would like to suggest that Retirement planning is not just about hitting a certain number. It is about ensuring your money can support a sustainable, dignified life, and more importantly, it is the life that makes our heart ticks, that bring sustainable happiness to us, and less anxiety; for as long as we need it to.

A number without time and life context is only half the story.

As I wrap this up, a helpful way to think about RIA is this:

They are maps, not destinations

The number are highly relevant today, but reduces over time

They are meant to guide us, not a substitute to personalised planning

Once we accept this, we can appreciate the benchmarks for what they are supposed to be, without expecting them to do more than they were designed to do.

And hopefully, this understanding allows us to use them wisely, instead of taking false comfort or unnecessary anxiety from a single headline number.

Only after we properly understand what these benchmarks means, can we meaningfully plan about:

Accumulating RM1.3 million, RM 3.3million; RM 8.291mil or whatever number may be for our own aspirations;

Whether the assumptions behind the projections apply to us, or what else are missing;

How much is “enough” for our life, so that we can live better today, and tomorrow, but not living in fear today; or only living in tomorrow.

Without this foundation, it’s easy to chase numbers and miss the life they’re meant to support.

Remember, the time that matters is today because this is the only time we are truly alive.

About the author

Kevin Neoh is a Certified Financial Coach based in Malaysia. He writes about money in the context of real life, where uncertainty, financial stress, and decision-making are part of everyday experience.

As a husband and a father to a child on the autism spectrum, Kevin is deeply aware that life rarely follows neat projections. His work focuses on helping individuals develop a healthier relationship with money — one that supports resilience, clarity, and long-term wellbeing.

Follow Kevin here